Council budgets and spending Budget FAQs

What does the council spend its budget on?

Around 77% of the council’s day-to-day budget goes on adults and children’s social care services, which support the most vulnerable people in the county’s communities.

The remaining budget is spent on waste and recycling, highways, leisure, youth services, housing, outdoor spaces and much more; services that people in Shropshire use every day.

How has the budget gap developed?

Councils all over the UK are facing pressure to their budgets, from increased demand for their services and increased costs of delivering these services.

For example, the number of children coming into residential care, funded by Shropshire Council, has almost doubled since 2020. In adult social care, the number of working age adults who need support has also increased. At the same time, costs of goods (such as fuel) have gone up because of high rates of inflation over a long period of time.

This is even more of a challenge for councils in rural areas, like Shropshire, because people who use council services are spread out over a larger area. This means that travelling time is longer and fuel costs are higher and it costs more to deliver many services than it does in towns and cities. The Rural Services Network Fair Funding Campaign explains more.

My council tax has increased this year, how will this be spent?

In 2024/25, Shropshire residents will pay 4.99% more for the part of their council tax bill set by Shropshire Council. The Government assumes that all local authorities will make the same increase, and this includes a 2% precept on adult social care.

95% of all councils with a responsibility for social care have raised their bills by this amount.

Council tax is our main source of income and since 2015/16 the proportion of our funding that comes directly from council tax has gone from 57% to 78% as government funding to councils has decreased.

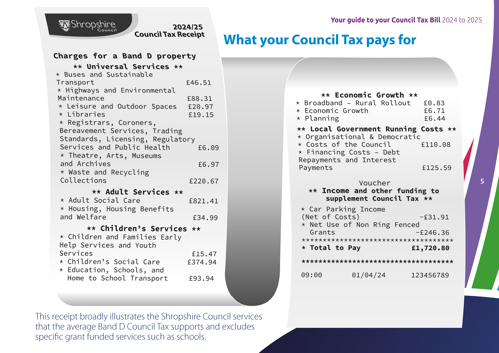

By far the biggest proportion of our budget is spent on social care, supporting the most vulnerable residents in Shropshire. It also goes towards waste collections, recycling, highway maintenance, schools, transport, leisure and many more services that residents use every day. This receipt gives an illustration – this may vary year by year and depends on different factors, including demand and inflation.

Which services could be changed?

Proposals for changes in 2025/26 include:

- moving to three weekly general waste collections

- reducing opening hours of the museum and castle in Shrewsbury

- switching off some streetlights for part of the time

- changing park and ride bus services in Shrewsbury

How will the council manage the impact of the proposed changes?

The plans to close our budget gap include decisions that we never wanted to make but have taken because we have no other choice. We are required by law to set a balanced budget.

We will continue to deliver statutory services, finding more efficient ways to do this wherever we can, but there will be a significant impact to residents and communities where discretionary services need to be reduced or stopped altogether.

We are committed to understanding the full impact of our decisions and mitigating the risks wherever possible. This will include robust Equality Impact Assessment and thorough consultation on any major changes. We will take account of all the feedback we receive and make the most informed decisions we are able to with the resources we have.

How will the council be resized as a result of its financial challenge?

It's estimated that resizing the council will contribute around £27m to the overall savings target of £62.5m.

As a simple average, this would be equivalent to a reduction of around 540 full-time posts when salary, pension and other on-costs have been considered. This is a higher number than we had originally talked about, but reflects the most up-to-date and accurate budget and workforce information we have available. This does not mean 540 redundancies.

The first steps to reducing the size of the council have already begun, with a programme of voluntary redundancy alongside a detailed review of every post, to establish where any vacancies can be removed to make savings without removing people. The council is also making workforce savings by recruiting existing agency staff, where this is appropriate, reducing agency fees and giving employment benefits to the people doing these jobs. These planned changes began with a reduction in senior management posts.

These steps are being carried out in this order, alongside detailed reviews of how services are being delivered across the whole council, to increase efficiency and to reduce any redundancies needed.

What proportion of council tax pays for the Council employees Pension Fund contribution?

What is the difference between capital and revenue budgets?

Lezley Picton, the leader of Shropshire Council, explains the crucial difference between these budgets in the following video...

How can the council spend money on projects like Smithfield Riverside or the North-West Relief Road when services are being cut?

Council budgets include capital spending and revenue spending, and these can be explained in household terms to make them simpler to understand.

Capital spending is one-off spending on things such as new buildings, machinery, equipment and even roads – in household terms it’s like buying a house.

Revenue spending is the cost of running our day-to-day services – to continue the household example this would be grocery shopping, energy bills and monthly mortgage or rent.

For the council, the North West Relief Road and Smithfield Riverside are both capital spending – costs that will be incurred once.

However, the £62m funding gap and pressure is on our day-to-day running costs like contracts with suppliers of services, staff salaries and running costs for buildings and vehicles. These are our revenue costs.

By law, councils cannot use capital funding for revenue spending. The Government offers incentives such as special grants and access to affordable borrowing to help councils fund capital projects, as these can have a long-term benefit for communities.

For example, the initial phase of the Smithfield Riverside development has been funded by the Government’s Levelling Up Funding and can only be used for this purpose.

The Secretary of State for Transport in October 2023 committed to fund the North West Relief Road.

As such these capital schemes will carry on, alongside our plans to make the savings we need in our day-to-day costs of delivering essential services that support the most vulnerable people in Shropshire.

What are the plans for household recycling centres?

All five recycling centres are to remain open, but close one day a week to help make the required savings.

Cabinet has also agreed a new booking system for the recycling centres, which will help to reduce queues at busy times and encourage more recycling by enabling centre staff to better engage with visitors.

What’s happening with garden waste collections?

Householders wanting to have their garden waste bins emptied will now need to subscribe to our garden waste service.

A 12-month subscription costs £56 per bin and will cover the period 1 October to 30 September. Garden waste collections have now stopped for anyone that hasn’t subscribed.

Though the collection of garden waste isn't a service that we must by law provide, it is one that we want to continue to provide. As not all residents need or want the service we’ll now be providing this as an opt-in chargeable service to those who need or want it.