Council budgets and spending Budget 2024/25

Becoming a financially sustainable council

The national picture

The financial pressures on councils across the country are immense and are only getting worse, with many struggling to balance their budgets. Demand for many services, particularly social care, continues to soar.

This is made harder by rising prices from high levels of inflation over a long period of time

Challenges unique to Shropshire

In Shropshire, our budget can’t meet demand for many of our services and we cannot continue the way we have in the past. The situation is even more acute for reasons unique to our county.

- 25.7% of Shropshire’s population is aged 65 and over. In England the average is only 18.6%. By 2043 this gap is forecast to grow.

- We have seen a growth in children looked after. This has increased by more than 80% since 2020.

- Shropshire is the 2nd largest inland county in England and sparsely populated. We have less than one person per hectare compared to a national average of more than 4. Travel and fuel costs make services more expensive to deliver.

Around 77% of our budget is spent on social care. This includes: looking after people who are older or have learning difficulties; and looking after children and families, including children in care; safeguarding; fostering; education; and those with special educational needs and disabilities. We expect that figure to increase more as demand for social care continues to grow, meaning there is even less to pay for other services.

In the past year, we have already saved £41.3m but this is not enough. We must do even more in 2024/25.

By law, councils must deliver a balanced budget and cannot spend more money than is available.

What are we doing to become a financially sustainable organisation?

We are looking at everything we possibly can to reduce spend, become a financially sustainable organisation and deliver a balanced, lawful budget.

During 2023/24, we have made the highest amount of savings we have ever made in a year, currently standing at £41.3m. However, there is now much more we need to do. With more demand for services and rising costs continuing, we expect to need to cut our spend by another £62 million next year.

We must review every aspect of who we are as a council, what we must deliver and why certain services exist in their current state.

Some of these services are statutory, which means we have a legal duty to provide them. Our budget plans will prioritise these as we focus on finding new ways to deliver them as efficiently as we can.

However, some of the services we provide are discretionary, which means they are not services we must provide, but choose to because they benefit the people of Shropshire.

That means we will be taking some very difficult and tough decisions that we know will affect a great many people and communities in Shropshire. It means we will become a smaller organisation with fewer staff. We don’t want to do this; however, we have no choice.

Why are we doing this?

Because we must. We have no choice and legally we must set a balanced budget.

How costs have increased

Adults’ Social Care:

- In 2023/24, this is forecast to cost £130m.

- This is £11m over budget

- The costs of care placements have risen sharply due to high rates of inflation over a long period.

Key causes of increase

- Residential, nursing and at home care fee increases

- Provider inflation

- Ageing population

- Children with complex needs moving to adulthood

- Working age adults

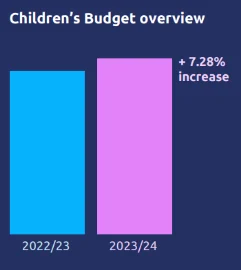

Children’s Social Care:

- In 2023/24, this is forecast to cost £52m.

- This is £3m over budget

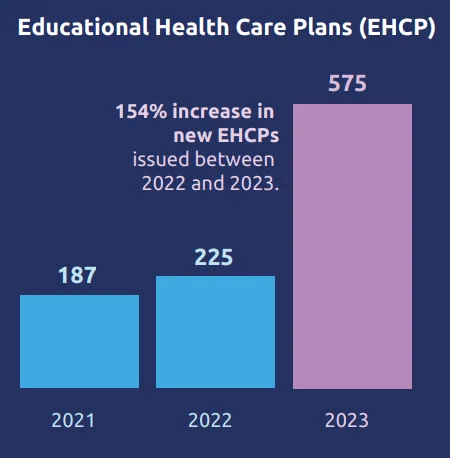

- Since 2020, there has been an 83% rise in the number of children in care in Shropshire.

- Residential care provider costs are rising, as well as transport costs for children with Special Educational Needs and Disabilities.

Key causes of increase

- We have 729 looked after children in Shropshire

- Stability of care placements

- Lack of foster carers

- Complexity of children’s needs, which leads to more expensive care

- Provider cost increases

Other budget areas

Almost every other area is forecast to see cost increases in the coming year.

How will we do this?

We will only become a financially sustainable organisation by taking a wide range of very difficult and tough decisions that are unpalatable, but absolutely necessary.

Specifically, we are focusing on the following areas:

- Reducing third-party spend: We spend some £376 million with companies, organisations and services from outside the council. This cannot continue, and we must find ways to reduce that spend.

- Income generation: Considerable sums of money come into the council from areas such as parking charges or planning fees. We must maximise income whenever and wherever possible.

- Managing demand: We must dramatically reduce demand for our services. If we fail to do so, these pressures will overwhelm the council in the very near future.

- Right-sizing and reducing our workforce: We must review every service we provide, and have the right people, doing the right jobs, delivering the right services, at the right times. Inevitably, this means that we will become a smaller organisation with fewer employees.

- Reviewing capital assets: As we become a smaller council, we will need fewer assets such as offices, which will also reduce day to day running costs.

Why we can’t use reserves and capital spend to pay for day-to- day services

Some councils are able to stave off similar financial challenges by using “rainy day” reserves that are there to pay for unforeseen emergencies all councils may face. In Shropshire’s case, after years of using these one-off reserves to close funding gaps, we now have below the recommended safe level for a council like ours.

Unlike central Government, we have very little scope to raise other taxes or generate other sources of income. We cannot borrow money to finance day-to-day spending.

We use what we call our ‘revenue budget’ to meet the cost of day-to-day spending such as salaries, supplies and services. We cannot use our ‘capital budget’, money for new buildings, machinery or other assets such as new roads, to fund the costs of running day to day services

Where our money comes from

Councils like Shropshire have four main sources of income:

- Council Tax

- Government grants

- Business rates

- Service charges and fees

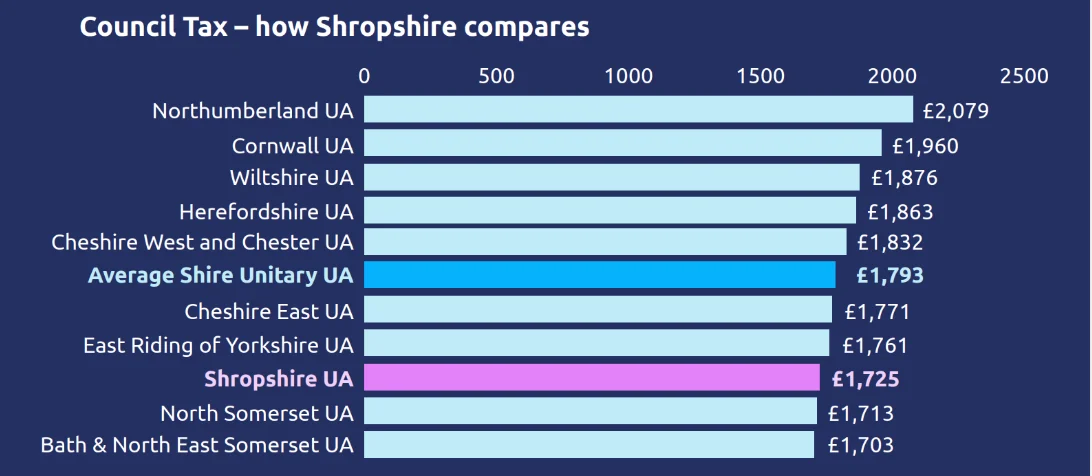

We cannot increase Council Tax to address our budget gap because government rules restrict increases to a maximum 2.99% and an extra 2% for adults’ social care. The 4.99% Council Tax increase we propose will generate an extra £6.5m, which is not enough cover the forecast increase in costs for adults’ social care.

Shropshire’s Council Tax at Band D is already £68 below the average of £1,793 for similar shire unitary councils. If Shropshire charged this average amount, it would generate around £9.5 million a year more in funding.

Council Tax is our main source of income and since 2015/16 the proportion of our funding that comes directly from Council Tax has gone from 57% to 78% as Government funding to councils has decreased.

When are we doing this?

We need to reduce our spending by an additional £62 million by March 2025. This timeline gives a guide of the key stages this year.

15 Feb 2024 – Our medium-term financial strategy is published with savings

21 Feb 2024 – Our Cabinet considers these proposals

29 Feb 2024 – Council budget set and savings proposals agreed

Spring 2024 – Public consultation on significant changes to services, for example charging for green waste

Spring 2024 to autumn 2024 – Discussions with partner organisations about the possibility of taking over and running council assets or services such as library or leisure provision

Summer 2024 – Consultations with services affected by proposed changes and any alternative ways to make savings

June/July 2024 – The first report on the impact of measures to reduce demand, spending and whether further action is required

Autumn 2024 – Start of implementation of service changes that need public consultation

Winter 2024 – If demand for services does not reduce and more funding is not available to meet these pressures, as we set our next budget we may need to find further savings

The average Shropshire Council Tax charge is lower than the majority of other unitary councils, ranked 42nd out of 63.

Shropshire Council Tax Charge: £1,725

Average Shire unitary charge: £,1793